Trading Process

Phycom is a Money Manager, Risk Mitigator, and Fintech Solution Provider in the Physical Commodity Trading Industry with over 30 years of experience in these areas.

We provide investors exclusive access to high-yield opportunities in diesel trading through a structured Bank Guarantee and SBLC-backed investment model. Our approach eliminates trading risks, allowing investors to achieve consistent, predictable returns without market exposure.

Phycom Trading via the Diesel Trading Platform has developed a solution for physical Commodity Trading, which enables High Yield and Low Risk to selected Investors.

Physical Commodity Trading should not be confused with Commodity Investing, and whilst perhaps not the oldest profession, this type of trading has almost always existed. As an essential link in the supply chain that provides everything from your morning coffee to the petrol in your car, Physical Commodity Trading is a huge global industry.

Phycom provides the skills and the infrastructure to manage both the Commodity Trading Execution Risk and External Client Capital. By using a Trading Platform that manages compliance, monitors process execution in real-time, and manages external investor monies in a regulated segregated client Trust, Phycom, via the Diesel Trading Platform, offers Capital Management to Independent Traders, via Bank Instruments, that have passed their strict due diligence.

Using this infrastructure Phycom can invite Qualified Investors to participate in Commodity Trading programs and share in the Independent Traders’ margin. Phycom believes in absolute transparency to evidence its commitment to capital preservation and will provide full access to its processes and system before any investment commitment and ongoing real-time reporting of the use of capital and the trading returns.

Phycom’s Solution targets Independent Traders in the diesel market. The Global Market is approximately $1.25 trillion annually, generating approximately $50–$70 billion in revenue for traders. The Independent Traders market Phycom targets is broken down as follows:

Trading Margin by Segment:

• Independent Traders: $9 Billion

• Major Trading Houses: $21 Billion

• Super Majors: $30 Billion

Definitions

Independent Traders

Independent Traders tend to be private companies with trading infrastructure that are more agile, focusing on specific markets or specialized services. The Independent Traders service Exit Buyers (Users of the Fuel) and can trade at higher margins than the Super Majors and the Major Trading Houses.

Commodity Investing

Commodity Investing is carried out by investors such as Hedge Fund Managers. They hold long or short positions on commodities based on their future price predictions.

Qualified Investors

Qualified Investors are UHNW (Ultra High Net Worth) individuals, family offices, or institutions. To be qualified, these Investors would have Property Assets which they can leverage to generate a Bank Guarantee from their top 100 banks.

Phycom only engages with a small number of select investors who have been introduced to the opportunity.

Super Majors

Super Majors are vertically integrated supply chains from production to end consumers. Owning all the links internally is very efficient but requires significant capital. Examples include Exxon, Shell, and BP.

Major Trading Houses

Major Trading Houses operate at a global scale, possessing substantial trading volumes and infrastructure. Examples include Trafigura and Glencore.

The Stakeholders

Supplier

Oil refineries that allocate diesel to sellers. The Sellers provide Bank Guarantees to the Supplier to receive their annual Allocations.

Independent Traders

Independent Traders are Private Companies with Trading infrastructure that are more agile, focusing on specific markets or specialized services. The Independent Traders service Exit Buyers and can Trade at higher margins than the Super Majors and the Major Trading Houses.

The Investor

The Investor provides the Bank Guarantee from their Bank which is used by Phycom to make a Payment Guarantee (SBLC) available to the Seller.

Seller

Sellers have Allocations of Diesel based on 12-month Contracts from Suppliers. The Seller manages the process of Loading their Vessels from the Suppliers Terminal and brings the Vessel into the Exit Buyers Port for Testing, Verification and Purchase.

Exit Buyer

The Exit Buyer is the user of the Diesel and the end Buyer of the Diesel in the Trade Process. The Exit Buyer distributes the Diesel for use by Consumers.

International Banks

All Bank Guarantees and Bank Instruments used in the Diesel Trading process are with Top 100 international Banks.

Attorney Trust Account - Paymaster

The Attorney acts as the Pay Master for the Trade Process via there Trust Account. The Attorney accepts the Payment from the Exit Buyer and then once the Funds are cleared and the Product Title is transferred to the Exit Buyer the Attorney pays the Supplier and all other parties involved in the Diesel Trading Platform.

Transparency

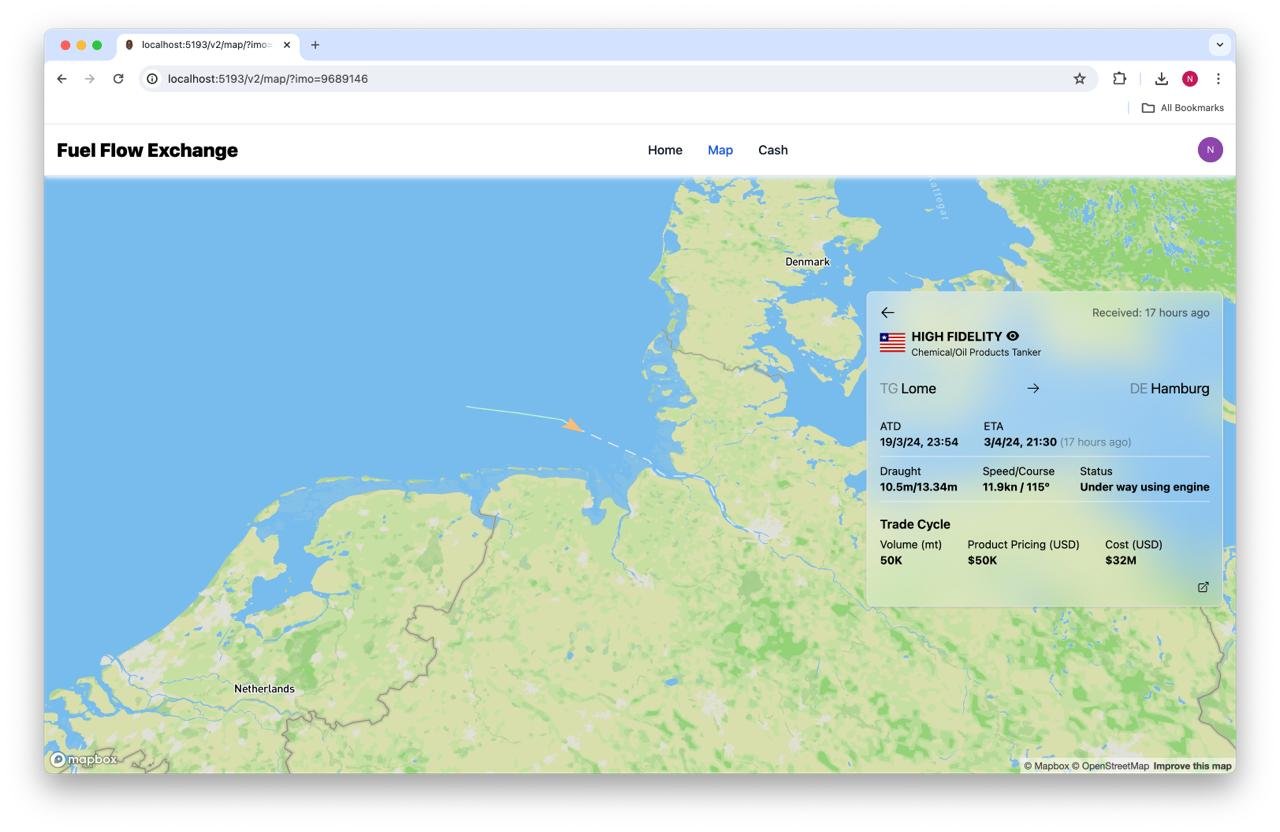

The Diesel Trading Platform provides a FinTech-based proprietary Diesel Trading Platform (Fuel Flow Exchange). It is managed by a multi-disciplined team that de-risks the whole trade process. The platform provides visibility, accountability, and transparency for all the stakeholders involved in the Diesel Trade. It is specifically aimed at Investors to give them complete visibility of the Diesel Trading Process.

This project creates an investment opportunity with premium returns by managing collateral, risk management, and demystifying a previously opaque process.

Anti Money Laundering

The Transparency of the process and the fact that we deal only with Tier 1 International Banks when managing Payment Guarantees and Payments via US Attorney IOLTA Trust Accounts eliminate the possibility of Commodity Trading being used for Money Laundering.